Economic Impact of Covid 19

The NZ Chamber in partnership with the NZ High Commission was pleased to host a business round table discussion on the impact of Covid 19 with special guest, Khoon Goh, Head of Asia Research, ANZ. Goh provided an update on the latest statistics, which he believes indicate the virus may have peaked in mainland China. Travel restrictions outside of Hubei are starting to ease and the visit by President Xi Jingping to Wuhan further serves as a signal the country is on the road to recovery.

While China activity is starting to pick up, Goh’s data indicates this has come at a huge economic cost with manufacturing indices falling significantly during the outbreak. The ANZ optimistic outlook for China in March, however, suggests a slow resumption of activity continuing into April, with the caveat that a renewed outbreak cannot be fully discounted. May is expected to show slightly weaker than normal pre-outbreak activity, due to weaker global demand, but be back up to speed by the end of Q2. Within Singapore, a second wave of infections early in March will delay recovery but Govt surplus has allowed stimulus packages to be rolled out to soften the blow. These are specifically aimed at preventing business failure and job loss.

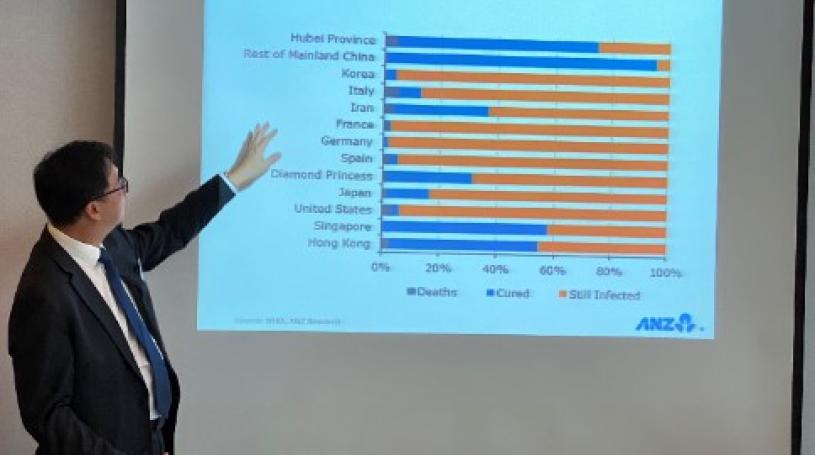

But how does ANZ view the rest of the world? Goh’s figures indicate the global outbreak is tracking a month behind China and yet to reach its peak. We have all seen the disruption to travel, trade, supply chains and financial markets, but what can we expect for Q2? Confidence will likely drop during the rest of March with a slump in domestic demand leading into April. High debt levels in the US could stress the credit market, while the already stretched European banking sector may face even more pressure. However, the warmer Norther Hemisphere temperatures in May, combined with containment measures, could see case numbers reduce in May. The ANZ optimistic view sees recovery and pent up demand then unleashed in June. The final outcome though will depend on the actions countries take now and their available fiscal buffer. A global recession may be unavoidable, but how many businesses can be saved during the downturn to make the most of the rebound is yet to be seen.

A range of impacts have been felt by senior business leaders who joined the conversation depending on their industry, footprint and level of exposure to China. For those with regional operations, changes in China production had led to an uptake in SEA manufacturing and the full impact was yet to hit the books. Others, however, have been forced to review strategies with projects postponed or market exited. Those with exposure to tourism, hospitality, food service and education sectors had seen decreased demand in these areas, while healthcare, crisis management and some professional services had seen increased demand. Common to all though was the focus on health and safety through travel bans, remote working and social distancing policies. In terms of the ‘what next’, nobody was prepared to make future predictions. The high number of variables and rapidly evolving situation has installed an unusually high level of uncertainty. Businesses are keeping a very close eye on the situation and preparing to adjust the ship as they go.

You can download the full presentation here.